In

1992, F & J (Fengjia International) was founded in Europe.

Under the background of "shock" transformation and shortage economy

in Eastern European countries, it found value. Based on the

"intangible assets" market and brand products of Chinese products

formed by the barter trade between the Chinese government and

central and Eastern European countries for more than 40 years, it

gave full play to the policy advantages of national export

orientation and started its own business to explore the

internationalization of Chinese enterprises.. In

1992, F & J (Fengjia International) was founded in Europe.

Under the background of "shock" transformation and shortage economy

in Eastern European countries, it found value. Based on the

"intangible assets" market and brand products of Chinese products

formed by the barter trade between the Chinese government and

central and Eastern European countries for more than 40 years, it

gave full play to the policy advantages of national export

orientation and started its own business to explore the

internationalization of Chinese enterprises.. |

|

In 1992, it signed a trade agreement with China Tobacco, which

brought Chinese tobacco into the European market for the first time.

In 1992, it signed a trade agreement with China Tobacco, which

brought Chinese tobacco into the European market for the first time.

|

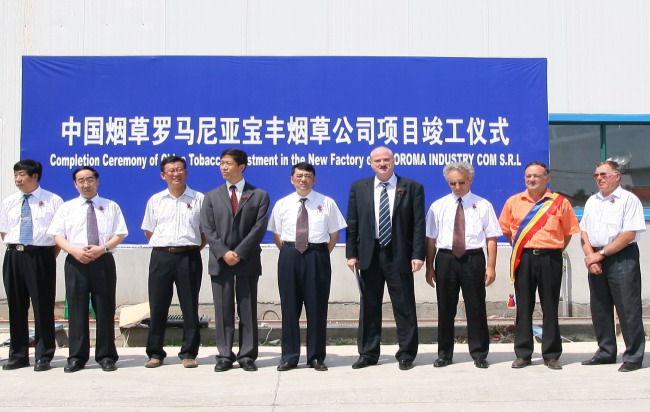

In

1995, it invested in the acquisition of state-owned

enterprises in Eastern Europe, put forward the "fast half" argument

of Chinese enterprises' internationalization, practiced the

innovation mode of Chinese enterprises' overseas industrial

investment, cooperated with Shaanxi Baoji cigarette factory to

invest in the establishment of Romania Baofeng tobacco industrial

company, the investment in the establishment of Lyme forest

industrial company, and the establishment of Romania China Europe

Industrial Park. In

1995, it invested in the acquisition of state-owned

enterprises in Eastern Europe, put forward the "fast half" argument

of Chinese enterprises' internationalization, practiced the

innovation mode of Chinese enterprises' overseas industrial

investment, cooperated with Shaanxi Baoji cigarette factory to

invest in the establishment of Romania Baofeng tobacco industrial

company, the investment in the establishment of Lyme forest

industrial company, and the establishment of Romania China Europe

Industrial Park. |

|

In 1995, it acquired the investment of Romanian state-owned

enterprise transformation industry and created an industrial park.

In 1995, it acquired the investment of Romanian state-owned

enterprise transformation industry and created an industrial park.

|

|

In 2004, F&J

International was honored as ^Top 20 Private Enterprises in Shanghai

Private Transnational Management ̄ In 2004, F&J

International was honored as ^Top 20 Private Enterprises in Shanghai

Private Transnational Management ̄

|

In 2005, the EU expanded eastward

and Chinese enterprises had a new opportunity to internationalize.

Romania (Eastern Europe) was proposed as the production base and

logistics distribution center for Chinese enterprises to enter the

EU market, breaking anti-dumping and realizing internationalization.

Based on Baofeng tobacco industry in Romania, China Tobacco

International EU production base has invested in expansion and

production. Shanghai Fengjia international won the honor of "2005

Shanghai top 20 multinational enterprises".

In 2005, the EU expanded eastward

and Chinese enterprises had a new opportunity to internationalize.

Romania (Eastern Europe) was proposed as the production base and

logistics distribution center for Chinese enterprises to enter the

EU market, breaking anti-dumping and realizing internationalization.

Based on Baofeng tobacco industry in Romania, China Tobacco

International EU production base has invested in expansion and

production. Shanghai Fengjia international won the honor of "2005

Shanghai top 20 multinational enterprises". |

|

Established the

European Industrial Park of Romania in 2007 and built the European

production and processing base for tobacco and timber in China. Established the

European Industrial Park of Romania in 2007 and built the European

production and processing base for tobacco and timber in China.

|

In 2008, in the context of the global

financial crisis, we will face the crisis directly and summarize

experience, transformation and development. Shaanxi DIAS Investment

Development Co., Ltd. Taking China's western region as its base, we

have played the experience of international investment and operation

of Feng Jia international for many years, and explored the

innovative mode of internationalization development of Chinese

enterprises under the background of "one belt and one road".

In 2008, in the context of the global

financial crisis, we will face the crisis directly and summarize

experience, transformation and development. Shaanxi DIAS Investment

Development Co., Ltd. Taking China's western region as its base, we

have played the experience of international investment and operation

of Feng Jia international for many years, and explored the

innovative mode of internationalization development of Chinese

enterprises under the background of "one belt and one road". |

|

In 2008, Zhao Leji,

secretary of the Shaanxi Provincial Party Committee, inspected the

Romanian European China Industrial Park. In 2008, Zhao Leji,

secretary of the Shaanxi Provincial Party Committee, inspected the

Romanian European China Industrial Park.

|

|

In

2010, it established the first batch of first-line equity

investment institutions rooted in the west, Shaanxi Detong, in joint

venture cooperation with domestic first-line investment

institutions, and successfully established equity investment funds

in the West for the first time, exploring and summarizing the

innovative mode of industry finance investment. In

2010, it established the first batch of first-line equity

investment institutions rooted in the west, Shaanxi Detong, in joint

venture cooperation with domestic first-line investment

institutions, and successfully established equity investment funds

in the West for the first time, exploring and summarizing the

innovative mode of industry finance investment. |

|

In May 2010, it

established a joint venture with DT Capital to establish the first

equity investment fund in the west. In May 2010, it

established a joint venture with DT Capital to establish the first

equity investment fund in the west.

|

|

Investing in the

Western European Business Center in 2012 Investing in the

Western European Business Center in 2012

|

|

High-end dialogue on

the new starting point of the Silk Road Economic Belt in August 2013 High-end dialogue on

the new starting point of the Silk Road Economic Belt in August 2013

|

|

In

2015, Shaanxi Financial Holding International Asset

Management Co., Ltd., one of the first batch of mixed ownership in

Western China, was established, and the first batch of "Shaanxi new

material high tech venture capital fund" invested by the Ministry of

finance was initiated. It is the first batch of high tech venture

capital fund invested by the Ministry of Finance in Western China.

It initiated the establishment of the first financial development

fund in Western China, and explored the innovative mode of

industrial and financial integration to promote the transformation

and development of regional economy. In

2015, Shaanxi Financial Holding International Asset

Management Co., Ltd., one of the first batch of mixed ownership in

Western China, was established, and the first batch of "Shaanxi new

material high tech venture capital fund" invested by the Ministry of

finance was initiated. It is the first batch of high tech venture

capital fund invested by the Ministry of Finance in Western China.

It initiated the establishment of the first financial development

fund in Western China, and explored the innovative mode of

industrial and financial integration to promote the transformation

and development of regional economy. |

|

Shaanxi New Materials

High-tech Fund was established in May 2015 Shaanxi New Materials

High-tech Fund was established in May 2015

|

|

Established in May 2016, established the first financial development

industry investment fund in Shaanxi

Established in May 2016, established the first financial development

industry investment fund in Shaanxi

|

|

In December 2016, Mr.

Geng Jian won the Special Award for Financial Innovation of Global

Chinese Influential People by Hong Kong Satellite TV. In December 2016, Mr.

Geng Jian won the Special Award for Financial Innovation of Global

Chinese Influential People by Hong Kong Satellite TV.

|

|

In May 2017, the US

Center for Silicon Valley High-Tech Innovation Center was unveiled

at F&J International. In May 2017, the US

Center for Silicon Valley High-Tech Innovation Center was unveiled

at F&J International.

|

|

In September 2017,

F&J International teamed up with Hollywood film master Slugu

Creative Culture Investment Service Xi'an Bank In September 2017,

F&J International teamed up with Hollywood film master Slugu

Creative Culture Investment Service Xi'an Bank

|

|

In September 2017,

SLUGU stayed in Xi'an Innovative Coffee Street and started the

opening ceremony with leaders such as Shaanxi Province Secretary

Wang Yongkang. In September 2017,

SLUGU stayed in Xi'an Innovative Coffee Street and started the

opening ceremony with leaders such as Shaanxi Province Secretary

Wang Yongkang.

|

|

In April 2018, China

Youth Innovation and Growth Enterprise Board (referred to as the

double-creation board), the country's first regional center open in

Slugu. In April 2018, China

Youth Innovation and Growth Enterprise Board (referred to as the

double-creation board), the country's first regional center open in

Slugu.

|

|

Bringing together the

global wisdom of Zhejiang University and focusing on the new

landmark of Silicon Valley in Xi¨an Silk Road. In July 2018, the

launching ceremony of the Western Conference of Zhejiang University

Global Alumni Entrepreneurship Competition was successfully held in

Slugu, Xi'an Pioneering Coffee Street District. Bringing together the

global wisdom of Zhejiang University and focusing on the new

landmark of Silicon Valley in Xi¨an Silk Road. In July 2018, the

launching ceremony of the Western Conference of Zhejiang University

Global Alumni Entrepreneurship Competition was successfully held in

Slugu, Xi'an Pioneering Coffee Street District.

|

|

In September 2018,

F&J International launched SLUGU 5311 target In September 2018,

F&J International launched SLUGU 5311 target

|

|

In

2019, Against the backdrop of significant changes in international economic and trade relations, we seize the historical opportunity for Chinese enterprises to "go global" and are committed to providing practical and innovative investment banking, service trade, and innovative education services for Chinese enterprises to invest and expand into the Central and Eastern European markets. With Hungary as the operational center, Central and Eastern European countries such as Romania, Poland, Serbia, etc. as the market potential, and professional knowledge elites with rich European market work experience as the human resources. In

2019, Against the backdrop of significant changes in international economic and trade relations, we seize the historical opportunity for Chinese enterprises to "go global" and are committed to providing practical and innovative investment banking, service trade, and innovative education services for Chinese enterprises to invest and expand into the Central and Eastern European markets. With Hungary as the operational center, Central and Eastern European countries such as Romania, Poland, Serbia, etc. as the market potential, and professional knowledge elites with rich European market work experience as the human resources. |

|

2018:Established Slugu Integrated Financial Services Center in

London.

2018:Established Slugu Integrated Financial Services Center in

London.

|

In 2019, the ^17+1 ̄ featured product ^Slugu ̄ cross-border production

and processing procurement center was launched in Central and

Eastern Europe.

In 2019, the ^17+1 ̄ featured product ^Slugu ̄ cross-border production

and processing procurement center was launched in Central and

Eastern Europe.

|

Slugu Overseas Postdoctoral Center established in cooperation with

Xi'an Jiaotong University in 2019 was Established at Xi'an Jiaotong

University Innovation Port.

Slugu Overseas Postdoctoral Center established in cooperation with

Xi'an Jiaotong University in 2019 was Established at Xi'an Jiaotong

University Innovation Port.

|

In November 2019, at the 2nd China Import Expo, Fengjia International promoted pragmatic economic, trade, and investment cooperation between Shaanxi and Serbia, as well as other Central and Eastern European countries。

In November 2019, at the 2nd China Import Expo, Fengjia International promoted pragmatic economic, trade, and investment cooperation between Shaanxi and Serbia, as well as other Central and Eastern European countries。

|

On January 12, 2024, the founding ceremony of the "the Belt and Road" Business Unit of the School of Industrialists of Xi'an Jiaotong Liverpool University was held in Taicang Campus of Xi'an Jiaotong Liverpool University. President Xi Youmin of Xi'an Jiaotong Liverpool University issued the appointment certificate of the industrial director of the "the Belt and Road" Business Unit to Mr. Geng Jian, chairman of Fengjia International.。

On January 12, 2024, the founding ceremony of the "the Belt and Road" Business Unit of the School of Industrialists of Xi'an Jiaotong Liverpool University was held in Taicang Campus of Xi'an Jiaotong Liverpool University. President Xi Youmin of Xi'an Jiaotong Liverpool University issued the appointment certificate of the industrial director of the "the Belt and Road" Business Unit to Mr. Geng Jian, chairman of Fengjia International.。

|

On May 13, 2024, the Center of the "the Belt and Road" Business Department (Central and Eastern Europe) of the School of Industrialists of Xi'an Jiaotong Liverpool University was invited to jointly launch the opening ceremony in Budapest, the capital of Hungary, with the Central European Investment Enterprise Service Center of the Hungarian Investment Promotion Agency. Mr. Geng Jian, the chairman of Fengjia International, the director of the "the Belt and Road" industry of Xi'an Jiaotong Liverpool University, and representatives of Hungarian industry and commerce, finance, science and technology education witnessed the event.。

On May 13, 2024, the Center of the "the Belt and Road" Business Department (Central and Eastern Europe) of the School of Industrialists of Xi'an Jiaotong Liverpool University was invited to jointly launch the opening ceremony in Budapest, the capital of Hungary, with the Central European Investment Enterprise Service Center of the Hungarian Investment Promotion Agency. Mr. Geng Jian, the chairman of Fengjia International, the director of the "the Belt and Road" industry of Xi'an Jiaotong Liverpool University, and representatives of Hungarian industry and commerce, finance, science and technology education witnessed the event.。

|

| |

In

1992, F & J (Fengjia International) was founded in Europe.

Under the background of "shock" transformation and shortage economy

in Eastern European countries, it found value. Based on the

"intangible assets" market and brand products of Chinese products

formed by the barter trade between the Chinese government and

central and Eastern European countries for more than 40 years, it

gave full play to the policy advantages of national export

orientation and started its own business to explore the

internationalization of Chinese enterprises..

In

1992, F & J (Fengjia International) was founded in Europe.

Under the background of "shock" transformation and shortage economy

in Eastern European countries, it found value. Based on the

"intangible assets" market and brand products of Chinese products

formed by the barter trade between the Chinese government and

central and Eastern European countries for more than 40 years, it

gave full play to the policy advantages of national export

orientation and started its own business to explore the

internationalization of Chinese enterprises.. In

1995, it invested in the acquisition of state-owned

enterprises in Eastern Europe, put forward the "fast half" argument

of Chinese enterprises' internationalization, practiced the

innovation mode of Chinese enterprises' overseas industrial

investment, cooperated with Shaanxi Baoji cigarette factory to

invest in the establishment of Romania Baofeng tobacco industrial

company, the investment in the establishment of Lyme forest

industrial company, and the establishment of Romania China Europe

Industrial Park.

In

1995, it invested in the acquisition of state-owned

enterprises in Eastern Europe, put forward the "fast half" argument

of Chinese enterprises' internationalization, practiced the

innovation mode of Chinese enterprises' overseas industrial

investment, cooperated with Shaanxi Baoji cigarette factory to

invest in the establishment of Romania Baofeng tobacco industrial

company, the investment in the establishment of Lyme forest

industrial company, and the establishment of Romania China Europe

Industrial Park. In 2005, the EU expanded eastward

and Chinese enterprises had a new opportunity to internationalize.

Romania (Eastern Europe) was proposed as the production base and

logistics distribution center for Chinese enterprises to enter the

EU market, breaking anti-dumping and realizing internationalization.

Based on Baofeng tobacco industry in Romania, China Tobacco

International EU production base has invested in expansion and

production. Shanghai Fengjia international won the honor of "2005

Shanghai top 20 multinational enterprises".

In 2005, the EU expanded eastward

and Chinese enterprises had a new opportunity to internationalize.

Romania (Eastern Europe) was proposed as the production base and

logistics distribution center for Chinese enterprises to enter the

EU market, breaking anti-dumping and realizing internationalization.

Based on Baofeng tobacco industry in Romania, China Tobacco

International EU production base has invested in expansion and

production. Shanghai Fengjia international won the honor of "2005

Shanghai top 20 multinational enterprises". In 2008, in the context of the global

financial crisis, we will face the crisis directly and summarize

experience, transformation and development. Shaanxi DIAS Investment

Development Co., Ltd. Taking China's western region as its base, we

have played the experience of international investment and operation

of Feng Jia international for many years, and explored the

innovative mode of internationalization development of Chinese

enterprises under the background of "one belt and one road".

In 2008, in the context of the global

financial crisis, we will face the crisis directly and summarize

experience, transformation and development. Shaanxi DIAS Investment

Development Co., Ltd. Taking China's western region as its base, we

have played the experience of international investment and operation

of Feng Jia international for many years, and explored the

innovative mode of internationalization development of Chinese

enterprises under the background of "one belt and one road".